Interest Rates and CRE: Where were we, where are we, and where are we going?

As countries around the globe were maneuvering out of a global pandemic it was a delicate balancing act to move forward safely and preserve economic health. At the start of 2023, global markets were vulnerable to deteriorating economic conditions. The United States was trying to maintain all the positive indicators while battling inflation. A major tool that plays a role in this is the Federal Reserve and the “Fed Funds Rate”.

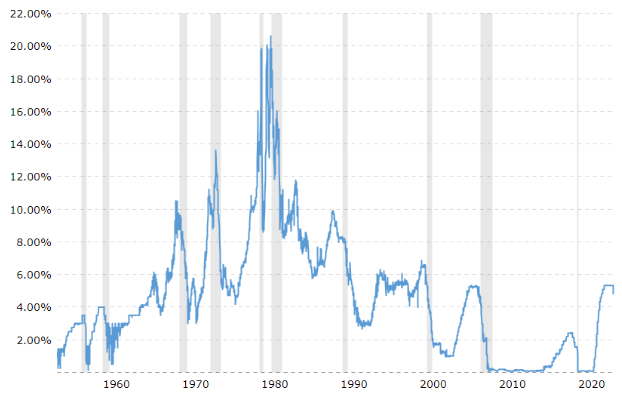

The most common interest rate index that the general populous is aware of is the “Fed Funds Rate”. This index dropped after the financial crisis in 2009. Even though the economy grew steadily after the “Great Recession of 2009” the Fed Funds Rate remained low. Even as the country saw record job growth, record low unemployment and record GDP growth all the way into 2018, we saw the Fed Funds rate remain at record lows. GDP began slowing 2018 into 2019, but things completely dropped out when the pandemic hit in 2020, sending the Fed Funds Rate to an even more historic low. We knew it would eventually have to normalize, but we also knew it would impact the cost of borrowing and then the appetite for buying real estate. It’s worth putting the present-day Fed Funds Rate in prospective with historical rates, to understand that our current environment is more normal than unusual.

As the economy recovered, coming out of the pandemic the Fed began raising rates in order to slow things down and curb inflation. The Fed hiked rates 11 times beginning in January of 2022. Rising rates put pressure on borrowers to service higher levels of debt. Delinquency rates increased (especially in the office segment). As we entered 2024 banks were forced to tighten their lending criteria on CRE and become selective about what projects they could finance while mitigating risk in a rate environment that we have not seen in several years.

As a smaller boutique Real Estate firm, Commercial Property Connect did see a shift in the type of transactions we were working on. We are diverse in what we work on; we do sales and leasing for the full spectrum of property types including office, retail, industrial, multi-family and land. While we have stayed busy, we did see more operating companies leasing as opposed to buying, we saw investors shifting from office or multi-family to more industrial and flex segments. We find ourselves working with more operating companies or “owner user” clients as opposed to the market being flooded with investors.

Fast Forward to September 2024- A 50 basis point drop from the FED as inflation has eased. It may be this is the perfect plateau or settling in the market. What do the experts predict? The Real Estate Sector leader Deloitte said they predict a “generational opportunity” in 2025. The Deloitte report draws on insight from a global survey of major commercial real estate owners and investment companies. The survey, which was conducted over the summer, asked 880 C-level executives and their direct reports about their company’s growth prospects in the coming 12 to 18 months, the shifts they anticipate in commercial real estate fundamentals, their investment priorities, and more.

“Our survey respondents have indicated that there has been a positive change in sentiment on the prospects of real estate broadly”

The reprieve in rates will have a positive effect on the real estate demand but will also ease fears about the greater than one trillion dollars in real estate loans that are coming due and will be adjusting to the current rate environment. Looking at the 2025 outlook on a more localized view here in Arizona there are optimistic predictions as well. AZ BIG MEDIA noted the following elements that may impact our 2025.

Hybrid Work and the Office demand. I know you are all sick of hearing this, but the hybrid work model seems to be permanent fixture and will continue to shape what type of office space is demanded.

Industrial Real Estate is just not showing any signs of slowing down

Sustainability and Environmental, Social and Governance (ESG) will be integral in CRE investments and influencing property values.

Shifts in Retail Spaces. Everybody sees it on the news, so many brick-and-mortar retail stores are getting smaller or going away. Retail will be different…think immersive experience instead of products!

The name of the game in Commercial Real Estate has always been the ability to adapt, which is more important now than ever. Make sure you choose a CRE partner that will walk the winding path with you and lead with insight.